We are choosing to reach out to all our Owners, not just those who have entrusted us with their market investments. The coronavirus (COVID-19) outbreak continues to impact the economy, global stock markets, and on a personal level. When we see this heightened level of volatility in the markets, it’s natural to worry.

Even though declines like the ones we are seeing now don’t feel good, history shows that a thoughtful financial strategy is still the best way to achieve your long-term financial goals. Staying committed to your personal long-term plan, even when it might feel uncomfortable, is a proven approach.

Some of the questions we have been hearing from Libro Owners include:

Should I make changes to my investments?

That answer to that question is, as always, “it depends.” You are not the stock market, and our investors collectively take a very balanced approach to their investment portfolios. If you are 100% invested in GICs, for example, then no there are no needs to make changes right now. If you are discovering that your portfolio is heavy in equities and you are feeling lots of anxiety, then yes, we should probably talk about adjustments, not wholesale changes.

Should I sell all my markets investments and go to cash right now?

No. Timing the market in this way is almost impossible to do correctly. Nobody knows with certainty when a market top or bottom is reached. What we do know with certainty is that selling your investments after a steep loss can have a significant negative impact on your financial future. Don’t lose twice.

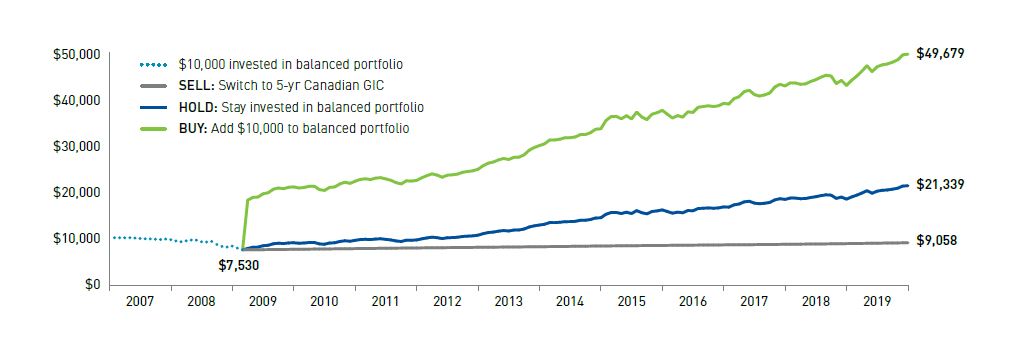

Please see the attached graph from one of our fund company partners, NEI, that offers perspective on the recovery from the 2008/09 financial crisis, and what might have happened if an investor had traded their portfolio for the safety of a GIC, stayed invested, or invested more at the bottom. We can’t say that this will be replicated today, but this pattern does repeat itself over time.

Who should I speak to about my personal situation?

Speak to your Advisor, or feel free to connect with one of ours if your investment business is elsewhere. We have dedicated wealth specialists, and financial planners for every Owner situation, regardless of complexity. None of our team gets paid sales commission, so rest assured our interests are your long-term interests.

Our advice at Libro is to focus on your long-term goals and, if you need to, discuss them with your Coach. Please don’t hesitate to get in touch with your Libro, Credential Securities or Credential Asset Management Inc. representative if you have questions or need support with your finances. We’re committed to helping you – for the long term.

Mutual funds are offered through Credential Asset Management Inc. Mutual funds and other securities are offered through Credential Securities, a division of Credential Qtrade Securities Inc. Credential Securities is a registered mark owned by Aviso Wealth Inc. The information contained in this report was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This report is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds and other securities.