Business Solutions

We know it takes time and commitment to run a successful enterprise, and we’re committed to helping you make the best choices to succeed.

How can we help?

Employer Services

Libro offers payroll services, financial literacy programs, group RRSPs and more.

Farms & Agriculture

Libro offers a variety of services for farms and agriculture businesses of all sizes.

Business Valuation

Measure the value of your business using InterVal. In less than 5 minutes and receive ongoing valuation reports.

Business Planning

Set yourself up for success with advice, tips, and tools for starting, managing, and growing your business.

Looking to move to Libro?

Whatever your business planning needs are, Libro Coaches are here to help your business prosper.

Payables and Receivables

Easily collect funds from your customers and make payments to your vendors, employees or the government.

Online Banking for Business

Online Banking for Businesses is a web- and app-based service providing business Owners the ability to switch between their business and personal accounts without signing in and out.

- Pay taxes from your account

- Set up and approve transactions on two-signer accounts

- Set up ‘View Only’ users to access transaction history

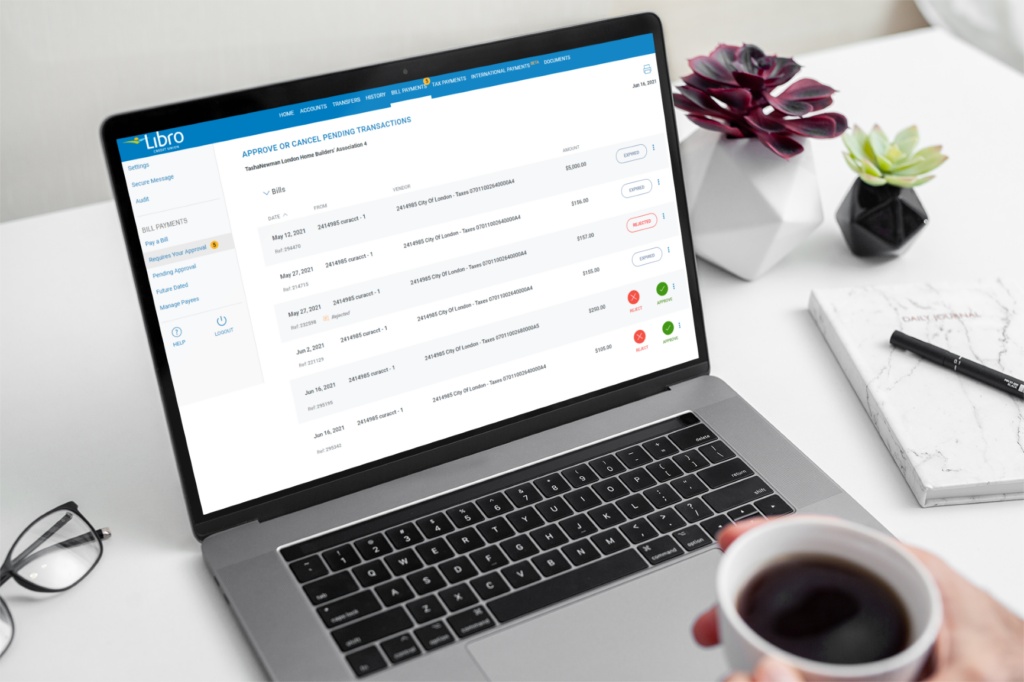

Commercial Online Banking

Commercial Online Banking is a web-based platform that provides 24/7 access to your Libro accounts, giving you more control over how you manage your payments and reporting.

- Provides secure and real-time information

- Allows for multi-approver transaction capabilities for more complex business structures

- Place stop payments on cheques or pre-authorized debits

Managing your Payables and Receivables

Payables

Receivables

Ready to grow your business with Libro?

Whatever your business planning needs are, Libro Coaches are here to help your business prosper.

- Commercial mortgages

- Business loans

- Online banking for businesses

Contact a Business Solutions Coach Today

Your privacy and trust are important to us; we recommend you do not share any sensitive information (such as passwords, Personal Identification Numbers or Account Numbers) within this contact form.