I was speaking with one of my colleagues recently about utilizing a responsible investment option in an investment portfolio. Her paraphrased response was,

“I’m interested in helping the planet, but not at the expense of my personal returns.”

It was a reminder to me that many Canadian investors still seem to be holding on to the fallacy that responsible investing is somehow detrimental to their personal investment success. They may ask, “Why invest in socially responsible investments?” or, “Does socially responsible investing even work?”

Libro believes that responsible investing can lead to better financial returns while contributing to positive social and environmental impact.

Let’s start with the basics.

What is responsible investing?

According to the Responsible Investment Association (RIA) of Canada, responsible investing “refers to the incorporation of environmental, social and governance factors (ESG) into the selection and management of investments.”

ESG issues are already driving change in the world today. These are not just activist concerns; these are important economic issues with significant implications for every investor. Issues include:

- Climate change

- Water scarcity

- Leadership diversity

- Executive compensation

- Environmental impact

- Supply chain security

- Food availability

Responsible investments have increased exponentially in recent years as investors have recognized the opportunity for better risk-adjusted returns, while at the same time, contributing to important social and environmental issues.

The latest Canadian Responsible Investing Trends Report showed that assets in Canada being managed using one or more RI strategies increased from $1.5 trillion at the end of 2015 to $2.1 trillion as of December 31, 2017. This robust growth represents a 41.6% increase in RI assets over a two-year period. Canadian RI assets now account for more than 50.6% of total Canadian assets under management, up from 37.8% two years earlier.

As for the global market, the latest Global Sustainable Investment Review showed that global responsible investment assets reached US$22.89 trillion at the start of 2016, a 25% increase from 2014.

In the past 5 years, average annual fund flows to RI investments were 30x greater than in the previous 5 years.

How does responsible investing work?

There are a number of ways to implement responsible investing practices. Some are very deliberate and targeted, such as negative screening — for example, excluding tobacco from an investment portfolio. Other ways to implement socially conscious investing involve longer-term thinking and engagement such as shareholder engagement (e.g. voting proxies) and impact investing.

Do Canadians care about responsible investing?

The latest RIA Investor Opinion Survey shows that the vast majority of Canadian investors are interested in socially responsible investments. The report found that:

- 77% of investors are somewhat to very interested in responsible investing.

- 82% of investors would like to dedicate a portion of their portfolio to responsible investing.

- 77% agree that companies with good ESG practices are better long-term investments.

Personally, I have seen a lot more evidence of considerations given to things like “locally sourced”, “organic, or “ethical” among others instead of making a positive social impact with investments. We make these decisions every day with our wallets. Investing responsibly is simply an extension of that way of thinking.

Bottom line, does socially responsible investing work?

The RIA reports on the quarterly performance of responsible investment funds in Canada. Data provided by Fundata shows that 75% of Canadian responsible investment funds outperformed their average asset class return within the second quarter of 2019, and nearly three quarters of responsible investment funds outperformed over the one-year period ending June 30, 2019.

So yes, it works.

What’s in it for me, and my personal investments?

If you believe social issues matter to the long-term health and well-being of a business, and ultimately the future value of their stock price, you can no longer afford to ignore responsible investing considerations. These can include:

- brand value and reputation

- research and development

- customer satisfaction

- health and safety

- environmental performance

- governance

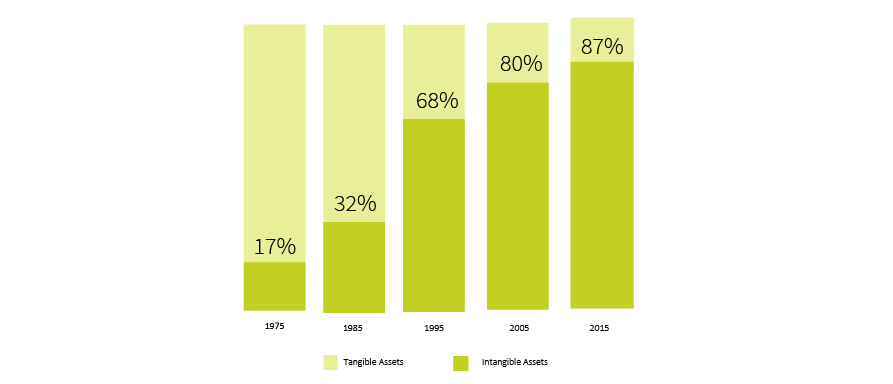

In fact, recent studies have shown that these “intangible” concerns can make up 87% (or more) of the value of large companies.

How do I start with responsible investing?

If you’re interested in socially responsible investing, talk to your investment specialist or financial planner to get started. Ask real questions about where and how your money is invested.

Libro is a proud Associate Member of the Responsible Investment Association. Many of our Coaches are also Responsible Investment Specialists, with many more pursuing the designation designed to help educate investors about these options. Make an appointment today and start making a positive change in your world — and your wallet.

Watch our responsible investing webinar

With responsible investing you can invest your money in products that are working towards a better tomorrow while making competitive returns.