As you learn more about Yooli you may have a few questions that can be answered through our FAQ. If something isn’t working as you expected, our best advice is to submit a support request directly in the app. You can find instructions on how to submit a support request under the how-to section. You can also reach out to Libro Connect 8am to 8pm Monday to Friday and from 8am to 4pm on Saturday by calling 1-800-361-8222 or emailing service@libro.ca.

General

Who can use Yooli?

If you bank with Libro, and have online banking set up, you can use Yooli! It’s as simple as using the same credentials you login to online banking with, to login to Yooli and get started. Download Yooli today from Google Play or the App Store!

Who is MX?

MX Technologies is our partner company and fintech that is helping us bring Yooli to life. Based out of Utah, MX’s mission is “Empowering the World to be Financially Strong”. Libro felt a strong connection to MX and their values, we are excited to be working with MX and building Yooli together.

Is Yooli Canadian?

Yooli is owned and managed by North American companies. Yooli is an app created by Libro and MX. Libro operates solely right here in southwestern Ontario. MX helped us build this app and currently operates much of the underlying technology. MX operates out of the United States. Your data and the technology is all managed in North America, and as we progress our relationship with MX, more of it will be operated and controlled by Libro here in Canada.

Why the name “Yooli”?

When we created the name Yooli, we pictured (Yo)u and (Li)bro coming together to make you better off. Yooli simply makes concepts like personal finances, sorting through advice and planning friendlier. Yooli is you and your money working together as one with help from Libro. You and Libro. Yooli.

I’m trying to connect my Collabria (Libro VISA) card, what does ‘one time code’ mean?

When Yooli asks for your “one time code” it is asking for your security code for your Collabria card. If you don’t know what your security code is, you can log into your Collabria online account – go to “My account” in the top right of the page > click “Select Your Security Code” and enter your code. This is what you will input into Yooli when asked for a ‘one time code’ to connect your Libro Visa (Collabria).

Why do I have to re-authenticate some accounts every time I login?

We hear you; it can be annoying to have to re-authenticate your accounts every time you login to Yooli so your data is up-to-date. Unfortunately, we don’t have a lot of control over how other financial institutions require this authentication. That’s because of the way we pull data today, it won’t be like this forever, but until Canada has an agreed upon approach for how to do this effectively (Open Banking), we are using an old-fashioned way to leverage your banking login details.

Don’t worry, your username and password are all encrypted and secure. The way it works is that we use this information on your behalf to grab that data and bring it back, however we don’t have access to your actual passwords or login information, all this information is highly encrypted to safeguard it from any potential bad actors.

How far back will my account information go once I connect an account?

Typically, 90 days of data is brought in when you connect a new account. This is so that Yooli can accurately create a budget based on three months of your spending. Sometimes an account will bring in more (or less) data, if you are seeing less than 90 days, submit a support request so we can look into why that might be happening.

What’s in the future for Yooli?

We’re constantly thinking about how we might make Yooli better. As we expand to more Owners, we’ll be using this as an opportunity to learn where our priorities should be based on your feedback and how you’re using the app. Some ideas we’re already looking at are:

- Setting personal financial goals

- Monitoring your credit score through Yooli

- Integrating many of these Yooli features right into Online Banking

- Bringing this data right to your Libro coaches. We want coaches to see your data, with your permission of course, so they can help you better work towards your financial goals

- Analyzing your local spending behaviour

And much more…

I’m having trouble with the app what do I do?

You can submit a support request right in the app to our technology partner, MX. Go to the menu icon in the bottom right, click “Help & Legal” and choose “Support Request”. Alternatively, you can also email service@libro.ca or call Libro Connect at 1-800-361-8222.

What can’t I see my Credential Asset Management accounts in Yooli?

If you have investments that show in your online banking, however are not pulling through to Yooli – that’s because you need to add them as a separate connection. Yooli automatically brings in your Libro data that’s directly held in our systems. We also partner with Aviso who offers products through Credential Securities, Credential Asset Management, Qtrade and Qtrade Guided Portfolios. To add any of those, go to accounts and click the ‘+’ button.

Can I connect my Libro business banking accounts to Yooli?

At this time, Yooli is built for personal finances, so Libro business account information will not connect. We know business banking is important and we’re working on exciting tools to support businesses as well. Stay tuned for more information on that!

How-to

How do I get started with Yooli?

Download the app, create an account using your Libro login information that you use for online banking, and begin to explore! We recommend you aggregate any of your accounts (credit cards, accounts held at other financial institutions) so Yooli can provide you the most accurate advice and information.

How do I add more accounts?

To provide an accurate picture of your finances, you should add accounts from every institution you have a financial relationship with. After all, you can’t track your total spending or make a realistic budget if you haven’t included your second chequing account or that credit card you’re paying off. Follow the five steps below.

Step 1: From the Dashboard, tap “View all accounts” on the bottom of the panel to bring up a list of accounts.

Step 2: Tap the “+ Connect” button at the top right to see a list of financial institutions.

Step 3: If you find your institution, move to step 4. If not, tap “Search Accounts” and enter the name of the institution you’re looking for. If you still can’t find it, search by its web address, such as:

https://www.collabriacreditcards.ca/affiliate_libro/ or www.qtrade.ca

If you still can’t find your institution, send a message to our support team by tapping “Help & Legal” from the Dashboard, and then “Support Request”. You also may want to add a manual account.

Step 4: Once you find your institution, tap its icon, and then enter the credentials you use to sign into that account.

Step 5: Tap “Connect” It may take a few minutes for your new account to connect.

How can I get help with Yooli when I experience an issue?

You can submit a support request right in the app to our technology partner, MX. Go to the menu icon in the bottom right, click “Help & Legal” and choose “Support Request”. Alternatively, you can also email service@libro.ca or call Libro Connect at 1-800-361-8222.

How do I reset my password?

First, it is important to understand that you use the same login credentials for Yooli as you would Libro’s online banking. That means when you reset your password for Yooli, you also reset your password for online banking.

To do this follow these easy steps:

Step 1: Call Libro Connect at 1-800-361-8222 and receive a temporary password.

Step 2: Login to online banking using your temporary password, it will prompt you to create a new password of your choosing.

Step 3: Use your new password to login to Yooli!

Libro Connect is open 8am to 8pm Monday to Friday and from 8am to 4pm on Saturday.

Reminder: We recommend creating a strong password using letters, numbers and special characters. Please remember to keep your password private.

How do I add assets to my net worth, like my house or car value?

You can add manual account(s) to track things with a lot of value: a house, a car, cash, a loan you’re paying back to a friend. You can also use this feature if any of the financial institutions you deal with are not supported by the software to make a direct connection. To do this, follow the six steps below!

Step 1: From the Dashboard, tap “View all accounts” on the bottom of the panel to bring up a list of accounts.

Step 2: Tap the “+ Connect” button at the top right.

Step 3: Scroll to the bottom, and tap “Add Manual Account”

Step 4: Give this account a name. It could be “Home,” “Other credit card,” or “Secret gold I’ve got buried.”

Step 5: Choose an account type:

Step 6: Enter the details.

How do I edit/categorize a transaction?

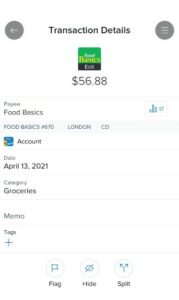

To edit a transaction, tap it to bring up a details window, and then you can tap any section to edit it. For example, the transaction details window should look like this:

From here you can edit the payee, date, and category. You can also add a memo (write anything about the transaction you think is important) and tags (by clicking the + button below).

Yooli does it’s best to categorize your transactions properly, however sometimes it won’t recognize the transaction and marks it ‘Uncategorized’ or it may be incorrect. You can easily click the category section and choose a better fit!

How do I use Yooli search?

Yooli has a powerful search, there is a search bar at the top the dashboard that says, “How can we help you today?”, when you tap the search bar there will be a list of suggested searches you can use, and you can also alter those questions or ask your own!

How do I hide or delete an account in Yooli?

When viewing an individual account, you can tap the ••• button in the top right corner for several options. Hiding an account tells the app to ignore the data (so it is not used to create your budget or reflected in your spending), you can also choose to unhide it at any time. Deleting an account will remove it completely, and this cannot be undone.

Privacy and Your Data

Is my data secure?

Your data is completely safe inside Yooli. Yooli access is protected by what we call “banking-level encryption”, just like your online banking account. We’re committed to keeping your information secure, and as such we implement privacy standards to guard against identity theft and unauthorized access to your information. We also regularly monitor and reevaluate our privacy and security policies and adapt them as necessary to deal with new conditions.

Who can see my data? Can my Libro Coach see it?

Libro and MX (our partner) will have access to your data, today we (Libro) will have access to mostly what we call aggregate data. This data will let us know how many people are using the app, how often they engage with it, behavioral data such as average financial health scores, etc. We want to use this data to help us improve the app and understand what’s important to our users (that’s you!).

Today, your Libro Coach cannot see your Yooli information (only your accounts with Libro). If you would like to reference your budget or spending information with your Coach, we encourage you to share that information, so they can use it to help find the best plan for you to reach your financial goals! We hope to share your data (with your consent) with Libro coaches in the future, so they can help you optimize your finances. This is a longer-term project for us. Today, this data is there for us to request from our partner MX if we want to further analyze individualized data, as stated it won’t be made available to Coaches in the early phases.

Both Libro and MX believe that you own your data and have a right to understand how it is being used. Our goal is to ensure you remain in control of your personal and financial data.

Why do I need to provide passwords from other banks to Yooli?

In order for you to see all your financial accounts in one app, we need to go out to the various banks and grab that data to bring it back to Yooli so you can see it all summarized. To make this possible, we need to login to the various banks on your behalf to grab that data and bring it back. Since Canada is still working towards an agreed upon approach on how to do this effectively (Open Banking), we need to do it the old fashioned way leveraging your bank login details.

Don’t worry though, your username and password is encrypted and just like Libro doesn’t know your Libro Online Banking password due to encryption, neither MX nor Libro will be able to see what your passwords are for other financial institutions either.

Can Libro or MX see my passwords from other banks after I put them into Yooli?

No. No one at Libro or MX will have access to your login credentials (username and/or password) from any financial institution that you add to Yooli. That includes your Libro password. All this information is highly encrypted to safeguard it from any potential bad actors.

What is Libro and MX’s privacy policy?

What is meant by “aggregated and anonymized” data?

When we talk about “Aggregated data”, we’re talking about looking at combining data from multiple individuals and looking at that data at the group level. By combining individual-level data and looking at it at a group level, it helps us see broader trends in the data to learn how Yooli is being used and to continue to improve your experience.

When you see “anonymized data” you know that those looking at the data don’t know the data belongs to you. Data can be anonymized by aggregating data together to look at it more at a group level or it can be anonymized by stripping all the information out that would enable someone to identify you within that data. So we would take out information like your name, your email, account numbers, etc.

Where is my data being stored?

We partnered with MX, a leading open banking technology company in Utah, in the United States. We partnered with them because well, simply they’re awesome. They’re aligned to Libro’s values and they’re building (in our opinion) better financial technology than anyone else in the market. We truly believe this partnership will help excel Libro’s purpose – helping to make our communities more financially resilient. Because our partnership is young, we are receiving some data from MX, however MX is managing most of the data flowing through the Yooli app.

How does MX and Libro protect my data?

Your data is totally safe inside Yooli. Yooli access is protected by what we call “banking-level encryption”, just like your online banking account. We’re committed to keeping your information secure, and as such we implement privacy standards to guard against identity theft and unauthorized access to your information. We also regularly monitor and reevaluate our privacy and security policies and adapt them as necessary to deal with new conditions.

To get technical: We use industry-accepted standards, protocols and precautions to protect your personally identifiable information (that’s the really important info that fraudsters are interested stealing in order to better impersonate you) from loss, misuse, unauthorized access or disclosure, alteration or destruction. We maintain physical, electronic and procedural safeguards for your personally identifiable information, including using firewall barriers, encryption techniques, authentication procedures, SSL (secure socket layer) encryption, and physical safeguards. In addition, we do not sell your personally identifiable information.